OFW for Filipino Business & Personal loan

Apply in Minutes, Get Funded in 1 Day

- Loans from 100,000 PHP to 5,000,000 PHP for micro businesses and sari sari

- Loans up to 5,000,000 PHP for small businesses and franchises

- Starts from 0.5% monthly interest rate

- No collateral, fast approval

Flexibility in Your Goals, Flexibility in Terms, Flexibility in Repayment

Find the product that will work best for your business.

Invoice Financing

Streamline cash flow with our Invoice Financing Loans, enabling quick access to funds based on your receivables without rigid terms.

Long Term Instalment Loans

Rewarding commitment with higher loan amounts and extended terms. Prove your reliability, and we'll invest more in your growth, offering you the financial flexibility your successful business deserves.

Short Term Working Capital Loan

Propel your business forward with our tailored loans, perfect for covering day-to-day expenditures and boosting your operational capacity.

Revolving Credit Line

Revolving credit line that you can use for your peace of mind – approved once, and you always have access to a renewable line of credit: money available to you at your request.

Career

Key Responsibilities

Meet and exceed the assigned sales and revenue targets though acquiring new customers for deposit, Retail SME and other lending products.

Understand customer’s lending needs and provide suitable solutions through consultation.

Collecting supporting documents, prepare credit memorandum with the provision of strong analysis, recommendation and business justification.

Manage and grow existing customer portfolio for FUM, loan, revenue and profitability. Leverage and expand customer relationship to maximize referral, cross selling and new business opportunities.

Contribute to the business success by initiating and participating in various cold-calling and marketing activities.

Provide high standard of service to all customers at all times and address all customer’s complaints/issues in the professional manner.

Manage the quality customer portfolio, maintain accurate records, and always follow the bank’s policies and compliance procedures.

Be vigilant on any early credit warning signs and make immediate report on potential financial or operational losses.

Stay updated with bank’s products suite, marketing campaigns and competitor’s activities to ensure superior product knowledge

Required education & experience

Minimum bachelor’s degree.

OR lower degree accepted if at least 3 years’ experience in similar position.

Computer literacy and English language proficiency.

Proven sales and service records in banking or related industries.

Financial background and credit background.

Required competencies

Discretion, integrity, and rigor.

Customer focus and strong communication skills.

Strong analytical skills with the ability to articulate complex issues.

Confidence, pro-active and ability to work under pressure.

Good planning, negotiation, problem-solving & organizing skills.

Desire to go extra and beyond responsibilities.

Be a team player and like to deal with challenges.

How it Works

Loan Application

with your business details

Evaluation

that help us evaluate you quickly and fairly

Loan Offer and Disbursement

within 1 day after your application is approved

How much loan do you want to apply for?

About Us

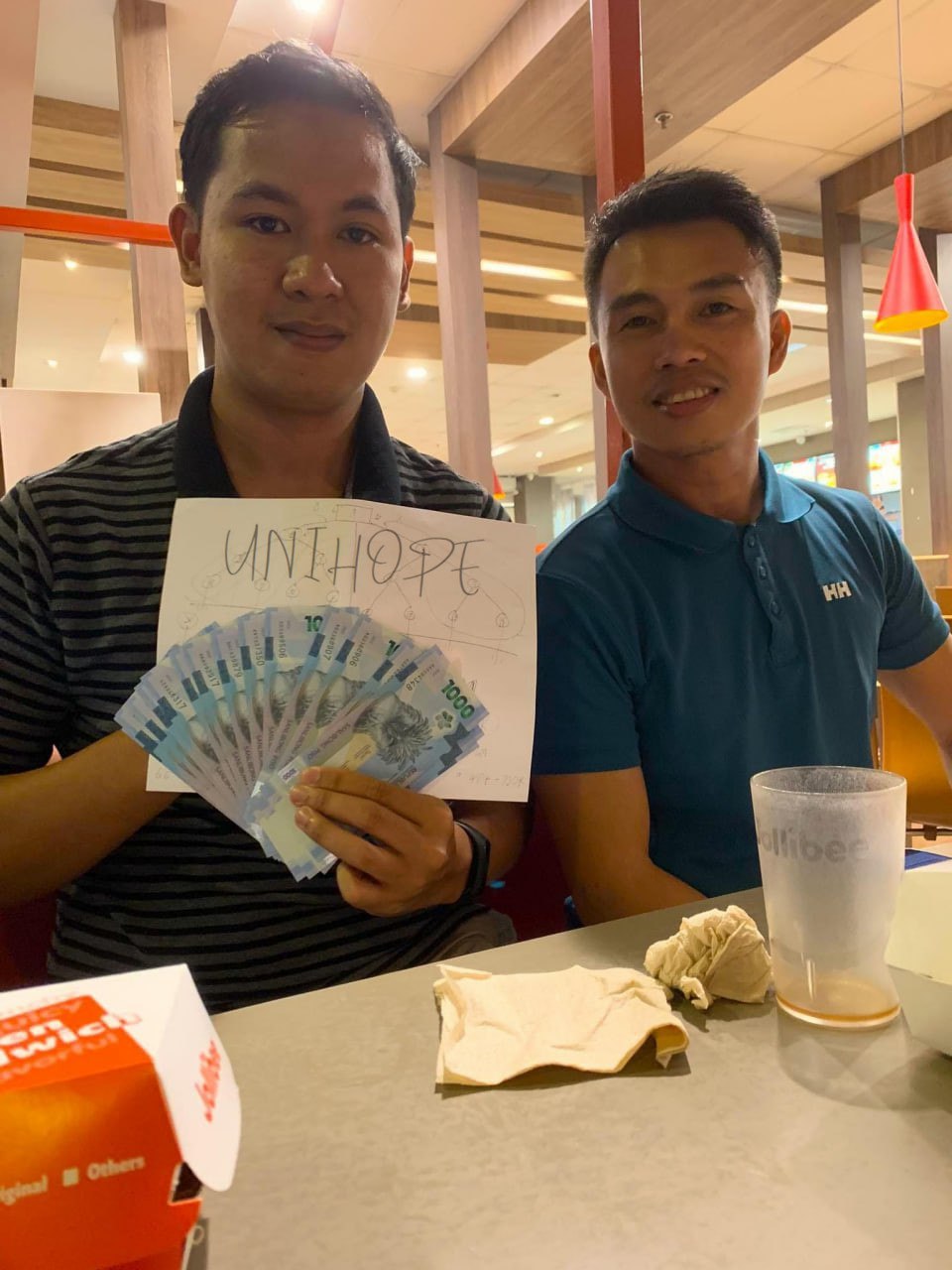

Unihope LENDING SERVICES INC. is a dedicated microfinance leader in the Philippines, proudly registered under SEC No. CS200303561 27, Aug-2008. Our mission is clear: to uplift Filipino lives by providing accessible, affordable loans tailored for micro, small, and medium enterprises. Our unique approach combines the personal touch of field agents with the efficiency of online payment gateways, ensuring comprehensive support and seamless service delivery to our clients.

Our Mission

Our mission is to empower every customer by being their primary financial partner, providing flexible, affordable services designed to promote and support their growth.

Our Vision

We envision becoming the foremost supporter of microenterprise growth in the Philippines, understanding and fulfilling their unique financial needs like no other.

Our Values

- Providing high-quality, affordable loan solutions.

- Fostering long-term relationships with our clients.

- Being responsive and adaptive to client needs.

- Continuously improving our services using a data-driven methodology.

FAQ

What types of loans does Unihope LENDING SERVICES INC offer?

"We offer a range of loans tailored for microenterprises, including short-term working capital loans, long-term recurring loans for strong businesses, and invoice financing loans for immediate cash needs."

How quickly can I receive loan funds after approval?

"Once approved, funds are typically disbursed swiftly, so you can start utilizing your loan to grow your business without delay."

What do I need to apply for a loan?

"Applying is simple! Just provide some basic business information, documentation of your business operations, and financial statements."

Can I repay my loan early without penalties?

"Absolutely! We support your financial freedom and allow early repayments without any penalties, aligning with our goal to facilitate rather than hinder your business growth."

How does Unihope LENDING SERVICES INC ensure the security of my personal information?

"Your privacy is paramount. We use state-of-the-art security measures to protect your personal and financial information throughout the loan process."

Is Unihope LENDING SERVICES INC regulated by any financial authorities?

"Yes, Unihope LENDING SERVICES INC is fully registered and regulated by the Securities and Exchange Commission (SEC) under registration number 2023060102998-03, ensuring compliance with all national financial regulations to provide you safe and reliable service."